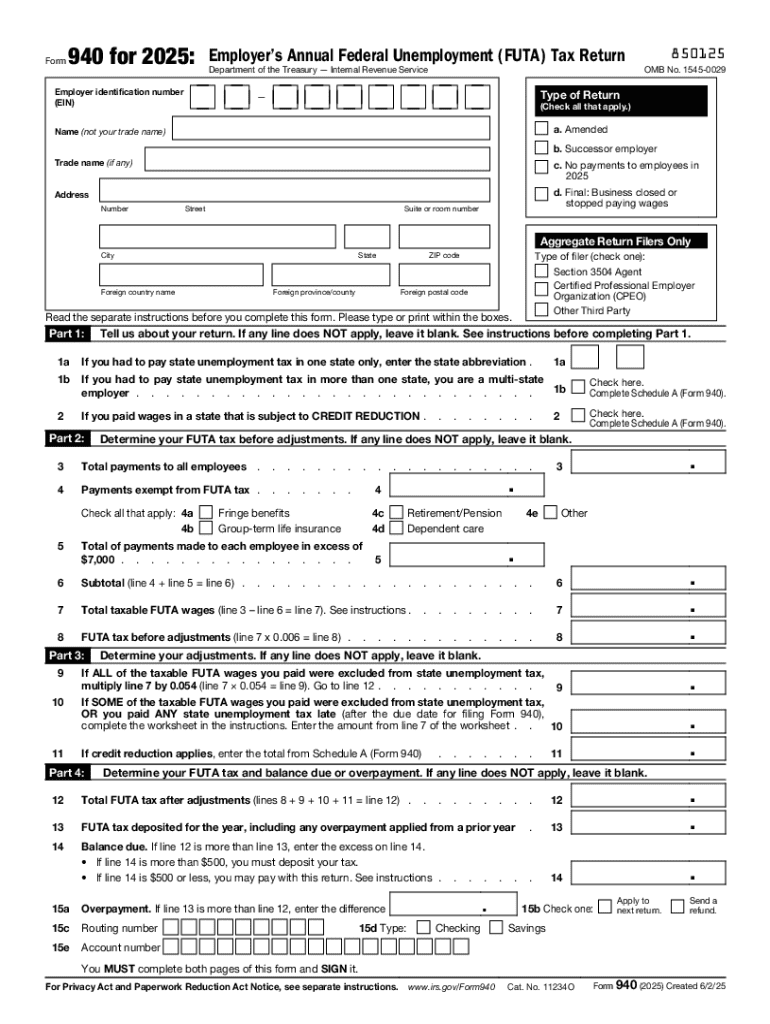

IRS 940 2025-2026 free printable template

Instructions and Help about IRS 940

How to edit IRS 940

How to fill out IRS 940

Latest updates to IRS 940

All You Need to Know About IRS 940

What is IRS 940?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 940

What should I do if I made a mistake on my IRS 940 form after submission?

If you discover an error on your IRS 940 after filing, you may need to submit an amended return using Form 940-X. It's essential to follow the specific instructions for correcting errors to avoid further complications. Ensure that your corrections are clearly marked to facilitate the processing of your amended form.

How can I verify the status of my submitted IRS 940 form?

To track the status of your IRS 940 form, you can use the IRS's e-file tracking tools or contact their support line. Make sure to have your confirmation number and other filing details handy. In case of rejection, check for common codes that indicate the reason for the rejection.

What should I do if I receive a notice from the IRS regarding my IRS 940?

If you receive an IRS notice concerning your IRS 940 submission, first read it carefully to understand the issue. Gather all relevant documentation to address the notice, and respond accordingly by the specified deadline. It's advisable to consult a tax professional if the situation seems complex.

What common errors should I be aware of when filing the IRS 940?

Common errors when filing the IRS 940 include incorrect employer identification numbers and miscalculated payments. To avoid these mistakes, double-check all entries and ensure that calculations are accurate prior to submission. Using reliable software can also help reduce errors.

What are the technical requirements for e-filing the IRS 940?

When e-filing your IRS 940, ensure that your software is compatible and meets the IRS's technical specifications. You should also use a supported web browser and have a stable internet connection. Regular updates to your software will help to comply with the latest e-filing standards.

See what our users say